does new mexico tax pensions and social security

52 rows Retirement income and Social Security not taxable. That means no tax on your pension.

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Ad The Leading Online Publisher of National and State-specific Social Security Legal Docs.

. Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota. The bill includes a cap for exemption eligibility of 100000 for single. States that do not tax pensions include the seven states that have no income tax Alaska Florida Nevada South Dakota Tennessee Texas and Wyoming as well as New Hampshire and Washington.

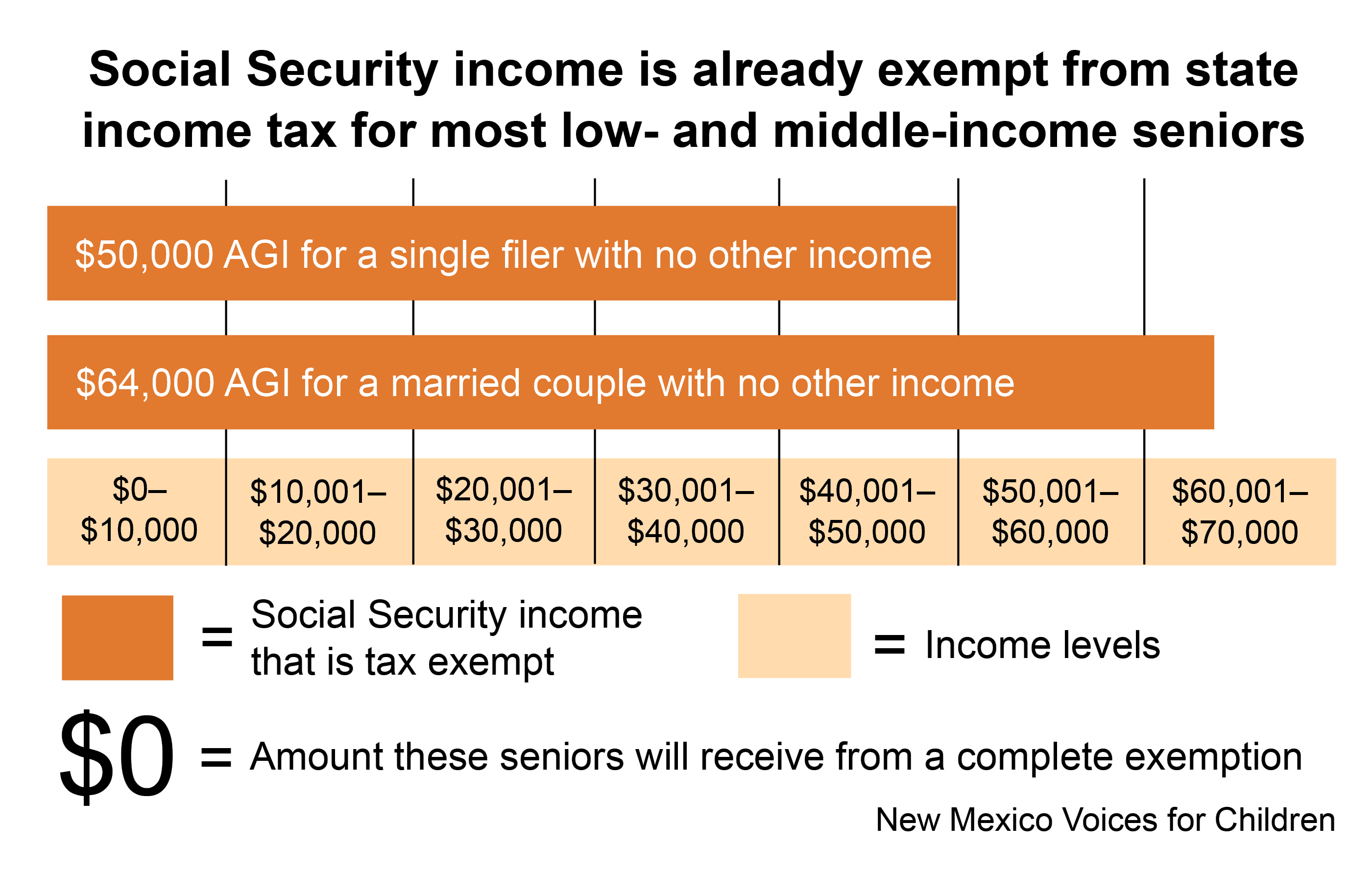

Localities can add as. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. Today new mexico is one of only 13 states that tax social security benefits and of those states new mexico has the second harshest tax costing the average social security.

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. At 65 to 67 depending on the year of your birth you are at full retirement age and can get full Social Security retirement benefits. Alaska and New Hampshire are the only states with no sales income.

Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt from filing and paying New Mexico personal income. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500. Social Security benefits are taxed to the same extent they are taxed at the federal level.

Social Security benefits will still be taxed for beneficiaries in New Mexico who earn more than 100000 each year. Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. The state currently imposes a tax on interest and dividends instead although its being phased out and will be completely repealed in 2027.

Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. Of the 50 states 13 states tax Social Security benefits. As with Social Security these forms of retirement income are.

Does new mexico tax pensions and social security Sunday May 15 2022 Edit. New Mexicos tax on Social Security benefits is a double tax on individuals. At what age is Social Security no longer taxed.

But the tax will be eliminated for those who earn less thanks to. New Law Ends Social Security Tax for Most New Mexico Retirees A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the. It allows individuals aged 65 and over with a GDI of 51000 or less.

Michelle Lujan Grisham Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal. Is Social Security taxable in New Mexico. Additionally five states Alabama Hawaii Illinois Mississippi and Pennsylvania exclude pension income from state taxation.

Yes Deduct public pension up to 37720 or. State Taxes on Social Security. Sales taxes are 784 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill.

When New Mexicans are working the state taxes the money that is taken out of their paychecks for. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

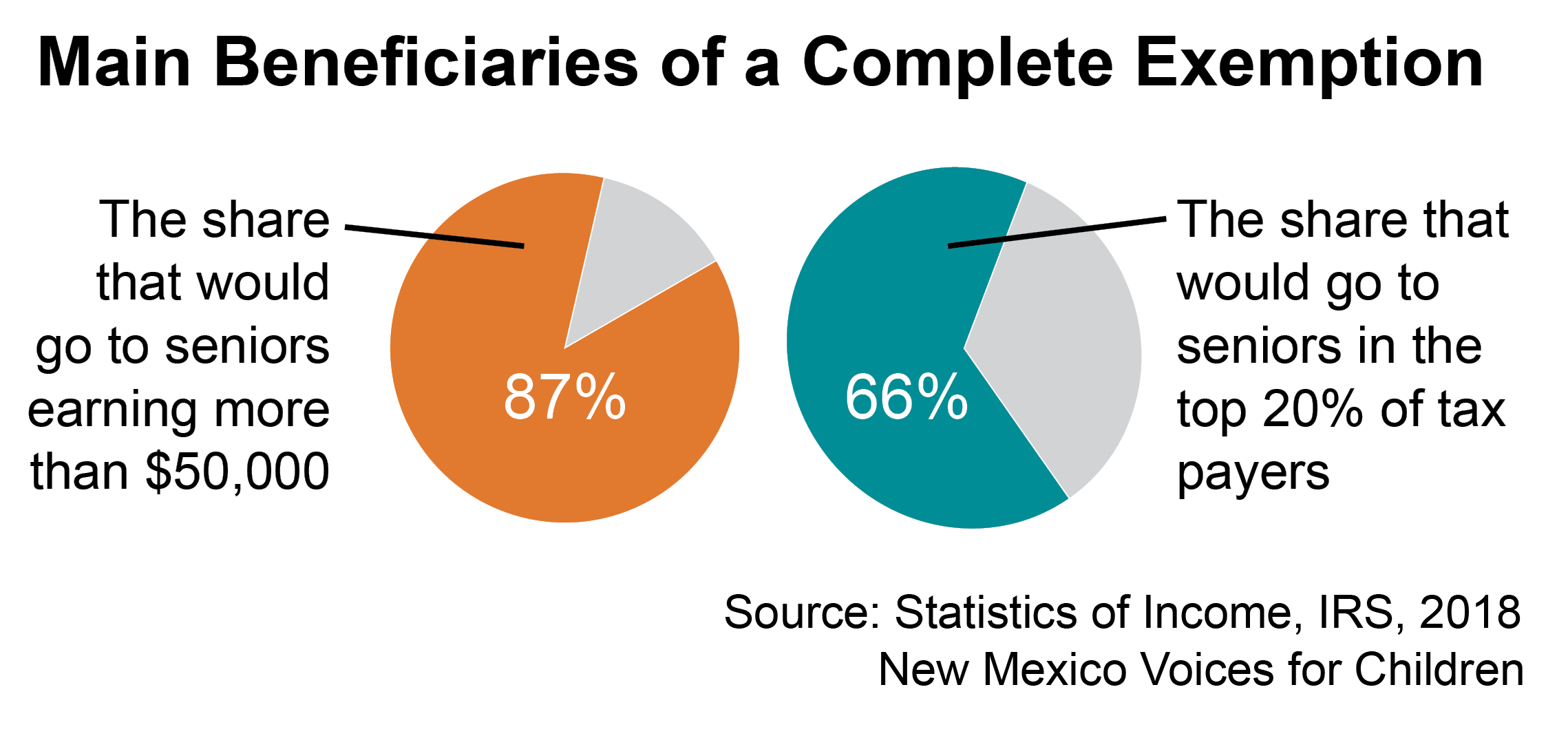

Exempting Social Security Income From Taxation Not Targeted Not Necessary Not Cheap New Mexico Voices For Children

Exempting Social Security Income From Taxation Not Targeted Not Necessary Not Cheap New Mexico Voices For Children

38 States That Don T Tax Social Security Benefits The Motley Fool

Social Security Income Tax Exemption Taxation And Revenue New Mexico

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Expat Taxes Who Pays What To Whom Tax Residency Issues Usa Canada Expat Ecuador Retirement Planning

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

These 12 States Don T Tax Social Security As Much As You Think The Motley Fool

How Taxes Can Affect Your Social Security Benefits Vanguard

U S Spends Comparatively Little On Public Disability Benefits Budgeting Disability Public

How Taxes Can Affect Your Social Security Benefits Vanguard

All The States That Don T Tax Social Security Gobankingrates

Taxation Of Social Security Benefits Mn House Research

Social Security Income Tax Exemption Taxation And Revenue New Mexico

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Exempting Social Security Income From Taxation Not Targeted Not Necessary Not Cheap New Mexico Voices For Children